Why the FRAKT are you not paying attention?

A Deep Dive Into FRAKT And Pawnshop Gnomies. Passive Income Play.

Basics

Floor price: 1.8 SOL for FRAKT and 3.5 SOL for Pawnshop Gnomies

Supply: 10,000 for FRAKT and 5555 for Pawnshop Gnomies

Listed: 195 for FRAKT and 202 for Pawnshop Gnomies

Background

Frakt emerged from the Solana hackathon in early 2021, where Timur (CEO), Vlad (Dev/Designer) and Vedamir (CTO) birthed the idea. Innovating right from the get go, the Frakt team was the first to launch a generative art collection on June 7, 2021, when only 2 other NFT projects existed on Solana at the time. Magic Eden wasn’t even around then. Fast forward 4 months and Frakt was the first project to launch staking. 5 months after launch, they once again broke ground by being the first to fractionalize an NFT on Solana. It was around Feb/march of 2021, when another project called Pawnshop Gnomies issued the first on chain loan backed by a Solana NFT, a feat that led to Frakt and Pawnshop Gnomies merging on Mar 15, 2021. With this merger Frakt pivoted to a DeFi meets NFT liquidity protocol that makes NFTs liquid, safe and accessible to everyone.

Currently employing 15 full time employees, Frakt is home to a suite of products designed to instantly unlock liquidity from both expensive and floor NFTs so that this liquidity can then be used to generate sustainable yields using DeFi. These products include:

Loans – Users can get $SOL liquidity using their NFTs or pool tokens as collateral. 50% of the fees generated from the borrowing product will be shared to the associated projects or DAO.

Lending - Deposit SOL into the lending liquidity pools to earn the interest paid by the borrowers.

Pools - Users can add their NFTs into a collection specific NFT Pool to receive the associated fungible pool tokens in exchange for their contribution to the pool. Pool tokens can then be instantly swapped for $SOL or $USDC liquidity, or used to redeem specific/random NFTs from the pool. Users can therefore buy, sell and swap NFTs instantly. This product is targeted at floor price NFTs. As a project or DAO, creating a liquid NFT Pool for your collection will create market arbitrage opportunities bringing an overall higher volume for the collection therefore generating both pool fees and higher marketplace royalties.

Liquidity & Inventory Staking - Users and communities can stake their pool tokens to earn 80% of the fees generated by each interaction with the pool. For projects and DAOs owning floor NFTs, providing some of their inventory to the pool and becoming the initial liquidity provider is a great way to unlock an additional revenue source.

Vaults - Users and communities can fractionalize single or multiple NFTs (NFT Baskets) into fungible fraktions. A vault is the entity that locks the NFT, issues the tokens linked to the fraktionalization and manages the buyout process. Fraktions can then be sold, distributed to communities or provided as liquidity to earn trading fees. This product is targeted at expensive/rare NFTs & collections.

Guard - New NFT collections to be minted and Launchpads can use our “Initial Liquidity Offering” (ILO) solution in order to ensure post mint liquidity, therefore preventing rugs and making teams more accountable. Part of the SOL raised during the mint is automatically added and locked as $TOKEN/$SOL pool liquidity. Minters can then instantly sell and reroll their newly minted NFTs.

At this point, if you are asking, what sets Frakt apart from it’s competitors, it’s their relentless focus on user experience. When talking tangibles, making users a top priority means:

For Lenders

* Yield that starts accruing instantly after depositing (no need to wait for the loan being opted into by a unique borrower) and accrues every second

* Lenders can deposit and withdraw anytime

* Compound interest (lenders don’t have to harvest and redeposit manually)

* Lenders can fund bluechip collections without the need to fund a full NFT (some are very expensive)

* Lenders don’t have to wait for borrowers in order for their sol to start accruing interest.

* Lenders don’t have to compete and be the fastest to fund the good loans

For Borrowers

* Flexibility for users via our different products (Flip loans, Perpetual loans, more coming)

* Instant liquidity (no need to wait for a lender on the other side)

* Linear fees accrual so can borrowers can open and close loans as they want for very low fees

* Grace period for borrowers so they have a last chance to repay their debt even if they have been liquidated

* Discord notifications about their loans

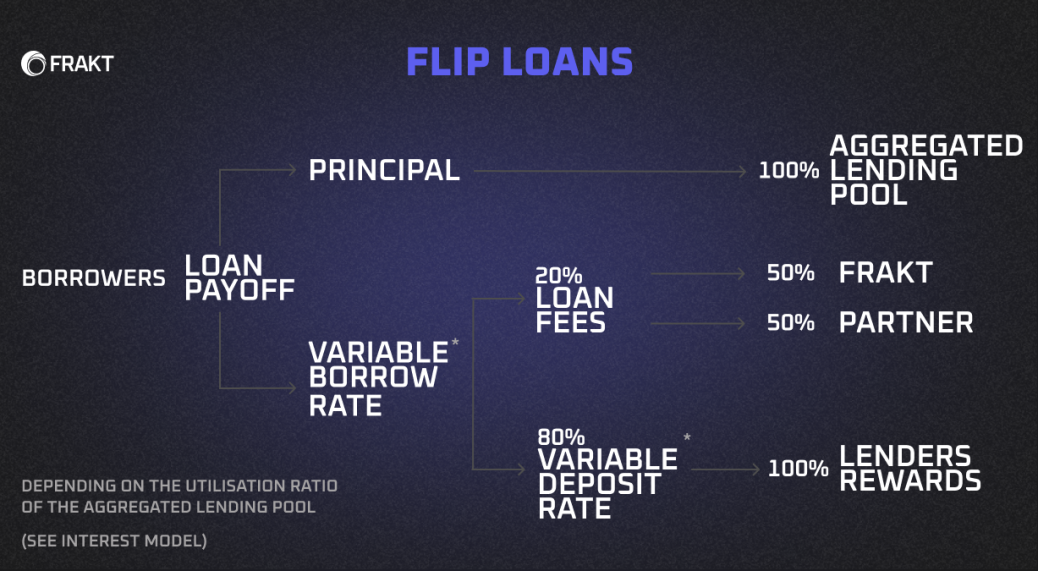

On a more general level, Frakt shares 50% of their profit from Flip loans to the respective NFT collection. A flip loan is one where borrowers can instantly borrow 20% to 50% of their NFT in SOL from the aggregated lending pool for that collection for between 7 and 14 days and pay a fixed fee with linear daily fee accrual. This opens up a new revenue source for NFT collections. For instance, Lifinity DAO and MonkeDAO deposited their DAO treasury funds in their lending pools to reduce borrow cost for their community and generate a decent yield at the same time. Frakt is currently working on new features and products that will enable higher loan to value for borrowers.

So far, Frakt’s loans have surpassed 50k in total value locked and lending protocol has generated more than 750 SOL in revenue. In parallel to that they have also distributed more than 200 SOL to their partner collections as part of their profit sharing mechanism. Revenues are expected to accelerate as new features and products currently in the pipeline are released.

Token / IDO

Frakt closed their seed round financing a few months ago and are currently preparing for their strategic round that will precede their IDO. The current plan is for the IDO to take place at the end of 2022 or early 2023 but that is extremely dependent on market conditions and can change in an instant. $FRKT is their pre-IDO governance token which will be migrated to the IDO token, $FRKX. $FRKX will become the utility token and is the token utilized for seed, private rounds and also airdropped to Gnomie holders. This token will play a central role in the Frakt ecosystem, from governance voting power, sustainable passive income to protocol related holder benefits.

The Frakt team worked extensively on their tokenomics to break the mold of shitcoins that people can farm or earn and dump. They wanted to build a strong token with strong intrinsic value and value accrual mechanisms and their seed and strategic round investors are buying locked $FRKX with a solid vesting schedule so at to align the interests of everyone involved. The team eschewed funds from VCs that would flip their token and chose to go with qualitative, experienced long term investors that will actively contribute to the growth of the protocol.

After all this, if you are wondering what benefits accrue to NFT holders, let’s break it down. As a holder, one can expect:

Every Gnomie and every 10 Frakt points (staked) unlock 1% discount on lending fees for Flip loans so that 100 Gnomies = 1,000 Frakt points = free loans. Note that free/discounted loans will be capped in value.

Every Gnomie in wallet and every 10 Frakt points (staked) unlock 1 ticket for the Liquidation raffles during which participants can purchase (bluechip) NFTs at 50% of floor price.

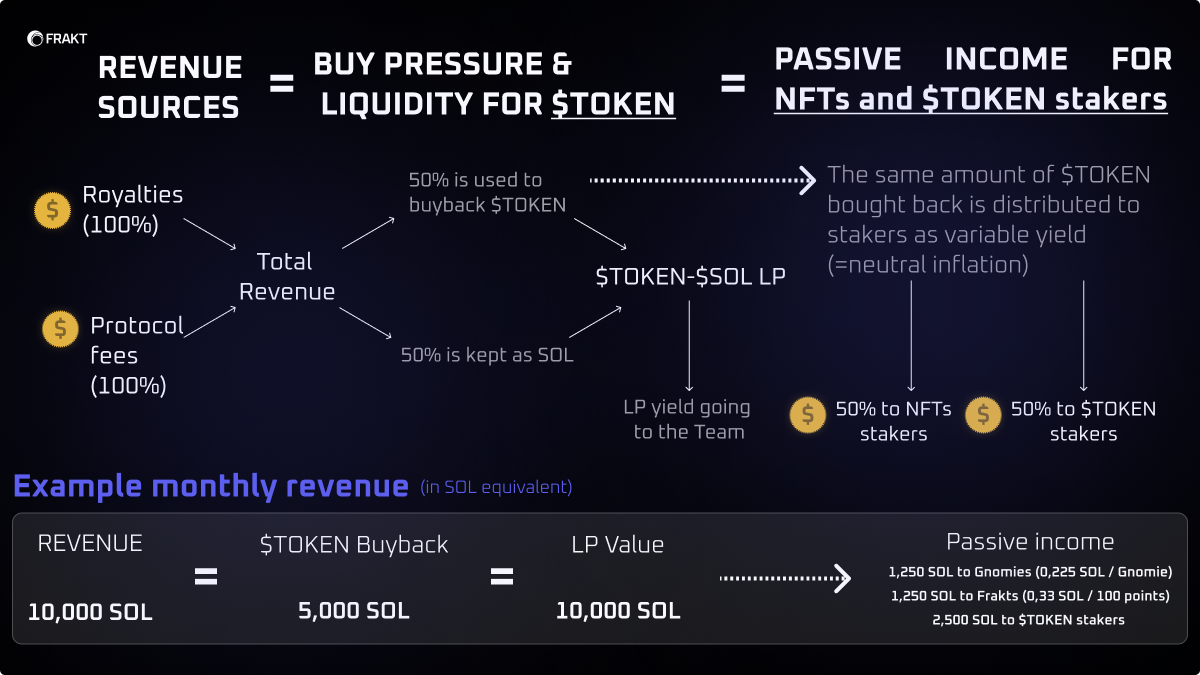

100% of royalties + 100% of protocol fees will be used to buy back their token. 50% of the buyback will be distributed to NFT stakers (25% to Frakts, rarity weighted; 25% to Gnomies, flat). The remaining 50% of the buyback will be distributed to token stakers. This mechanism results is a net neutral market impact for token inflation.

Chart analysis

Per Hello Moon, for the Frakt NFT, floor support is at 1.50 and resistance is around the 2.49 mark. Given that the current floor is closer to support than it is resistance, might make it an interesting candidate for accumulation. Further, with a 10,000 supply and 1141 owners, that averages out to each owner holding 8.7 Frakt NFTs. Seems like an interesting statistic to keep in mind. Listings have risen from 163 on August 13, 2022 to currently being at 195 though, in sympathy with the souring general market sentiment. The floor has gone from 2.18 SOL on August 13, 2022 to currently sitting at 1.8 SOL today.

For Pawnshop Gnomies, support seems to be around the 3 SOL mark. Listings have been rising from 164 on August 9, 2022 to the current 202. As for the floor, it has come down from 423 on August 13, 2022 to currently being at 3.5 SOL.

Of the two NFTs, I think Frakt might be the more attractively valued one at this moment.

Conclusion

The Frakt team has been blazing a new path from the very beginning. Iterating, pivoting and not afraid to experiment, their ethos reminds me of some of the most successful technology companies today. Some of you might have surmised my affinity for passive income projects from previous writeups, well, you can now add Frakt to that list of candidate’s worthy of a mention. I can’t wait to see the new features and products they deliver in the coming future and look forward with great anticipation to their IDO. I will be buying one or a few of these to sock away in my passive income portfolio. You have been warned.